Travel Insurance Benefit

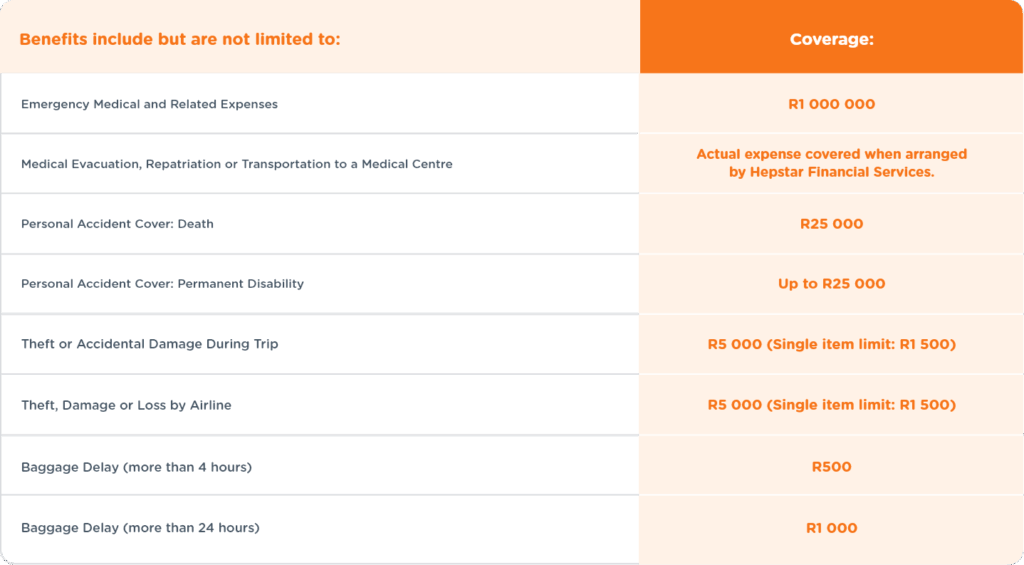

All TRA Gap Cover policyholders, under the age of 71, have access to the benefit of comprehensive travel insurance, the cost of which is covered by TRA, provided that you remain a TRA Gap Cover policyholder and ensure that premium payments thereunder are up to date. The said travel insurance is underwritten by Guardrisk Insurance Company Limited, a licensed non-life insurer, and administered by Hepstar Financial Services (Pty) Ltd, both being registered Financial Services Providers.

Click HERE for full details.

Should you plan to travel and have any enquiries about the cover or wish to request the documentation confirming cover, please contact

Hepstar Financial Services (Pty) Ltd on +27 (0)86 144 4548 or email info@hepstar.com.

Should you plan to travel and have any enquiries about the cover or wish to request the documentation confirming cover, please contact Hepstar Financial Services (Pty) Ltd on +27 (0)86 144 4548 or email info@hepstar.com.

Top-Up Travel Insurance

Exciting news! You also qualify to buy a top-up plan by clicking HERE to

increase your medical and baggage related cover, as well as add cover for trip

cancellation, pre-existing medical conditions, missed connections and more.

Exciting news! You also qualify to buy a top-up plan by clicking HERE to increase your medical and baggage related cover, as well as add cover for trip cancellation, pre-existing medical conditions, missed connections and more.

eSIM Services

If you are a TRA policyholder, and you need eSIM services, you have access to a unique link which will take you to the SIMTEX website – there, you will

Click “Get your eSIM” to purchase your eSIM and data. Your 20% discount will be applied upon checkout! Easy as that. To get your unique link, refer to

your year-end email communications from TRA, or contact membership@totalrisksa.co.za.

If you are a TRA policyholder, and you need eSIM services, you have access to a unique link which will take you to the SIMTEX website – there, you will Click “Get your eSIM” to purchase your eSIM and data. Your 20% discount will be applied upon checkout! Easy as that. To get your unique link, refer to your year-end email communications from TRA, or contact membership@totalrisksa.co.za.

Gap Cover is an insurance policy that covers the difference between

what your medical aid pays and what service providers charge for

in-hospital expenses.

Gap Cover is an insurance policy that covers the difference between what your medical aid pays and what service providers charge for in-hospital expenses.

Many South Africans are unaware of what medical gap cover is or why it's essential. A common misconception is that

Medical aid schemes often leave a gap (known as medical shortfalls) between what the medical aid pays and the actual

If you ask several people if they know what gap cover is, many might have a general idea, but often,

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.